Latest Articles

Car Buying Rule 20-4-10-50

Are you planning to buy a car but worried about overspending or managing your finances? The 20/4/10/50 rule is the ultimate guide to buying your dream car without breaking the bank! 🚘

In this video, we explain:

✅ Why a 20% down payment is essential.

✅ The benefits of keeping your loan term within 4 years.

✅ How to calculate an EMI that fits within 10% of your income.

✅ Why your car's price shouldn't exceed 50% of your annual income.

We’ll break it down with relatable examples, perfect for Indian families planning their next big purchase.

Nov. 17, 2024, 7:31 a.m.

Car Buying Rule 20-4-10-50

Are you planning to buy a car but worried about overspending or managing your finances? The 20/4/10/50 rule is the ultimate guide to buying your dream car without breaking the bank! 🚘 In this video, we explain: ✅ Why a 20% down payment is essential. ✅ The benefits of keeping your loan term within 4 years. ✅ How to calculate an EMI that fits within 10% of your income. ✅ Why your car's price shouldn't exceed 50% of your annual income. We’ll break it down with relatable examples, perfect for Indian families planning their next big purchase.

Nov. 17, 2024, 7:31 a.m.

Built Shelter

Around 400,000 BCE, Homo heidelbergensis built the earliest known shelters, such as oval huts with hearths, seen at Terra Amata in France. While early humans also used caves, constructing shelters provided protection and convenience near resources, supporting survival and innovation. Building shelter became essential, second only to agriculture in necessity, shaping early human development.

Nov. 9, 2024, 7:12 a.m.

Built Shelter

Around 400,000 BCE, Homo heidelbergensis built the earliest known shelters, such as oval huts with hearths, seen at Terra Amata in France. While early humans also used caves, constructing shelters provided protection and convenience near resources, supporting survival and innovation. Building shelter became essential, second only to agriculture in necessity, shaping early human development.

Nov. 9, 2024, 7:12 a.m.

Controlled Fire

Around 1,420,000 BCE, Homo erectus harnessed fire, vital for warmth, cooking, and protection. Initially kept continuously burning due to difficulty in reigniting, fire was later produced using flint or friction. Controlled fire enabled clearing land for agriculture, while mastering it led to metal smelting, advancing civilization beyond the Stone Age.

Nov. 9, 2024, 7:07 a.m.

Controlled Fire

Around 1,420,000 BCE, Homo erectus harnessed fire, vital for warmth, cooking, and protection. Initially kept continuously burning due to difficulty in reigniting, fire was later produced using flint or friction. Controlled fire enabled clearing land for agriculture, while mastering it led to metal smelting, advancing civilization beyond the Stone Age.

Nov. 9, 2024, 7:07 a.m.

Stone Tools

The earliest human invention was sharp stones, later purposefully shaped into tools like core, flake, and blade types during the Paleolithic period. Early tools helped with tasks like hunting, skinning, and constructing shelters. Techniques evolved over time, allowing humans to cut, grind, and shape materials, ultimately aiding survival and allowing primitive people to shape their environment.

Nov. 9, 2024, 6:55 a.m.

Stone Tools

The earliest human invention was sharp stones, later purposefully shaped into tools like core, flake, and blade types during the Paleolithic period. Early tools helped with tasks like hunting, skinning, and constructing shelters. Techniques evolved over time, allowing humans to cut, grind, and shape materials, ultimately aiding survival and allowing primitive people to shape their environment.

Nov. 9, 2024, 6:55 a.m.

Understanding the Power of ChatGPT: The Free Version’s Capabilities

ChatGPT’s free version offers notable features, including the ability to upload and analyze images. Users can request summaries or detailed explanations of visual content, making it a useful tool for education, business, and creative work. As AI evolves, ChatGPT’s capabilities are expected to become even more advanced.

Aug. 29, 2024, 8:35 a.m.

Understanding the Power of ChatGPT: The Free Version’s Capabilities

ChatGPT’s free version offers notable features, including the ability to upload and analyze images. Users can request summaries or detailed explanations of visual content, making it a useful tool for education, business, and creative work. As AI evolves, ChatGPT’s capabilities are expected to become even more advanced.

Aug. 29, 2024, 8:35 a.m.

Technology

Confusion Matrix

A confusion matrix is a table summarizing the frequency of predicted versus actual class in your data.

1) This is the most common and concise way to evaluate performance and compare classification models against one another.

Aug. 21, 2021, 10 a.m.

Confusion Matrix

A confusion matrix is a table summarizing the frequency of predicted versus actual class in your data.

1) This is the most common and concise way to evaluate performance and compare classification models against one another.

Aug. 21, 2021, 10 a.m.

How to write efficient SQL Queries

In development, writing the queries is not just important. It is also important to write efficient SQL queries. Efficient queries give faster results. When the SQL queries are optimized your application's faster performance saves a lot of time.

1) Use the exact number of columns

2) No need to count everything in the table

3) Avoid using DISTINCT keyword.

4) Create a small batches of Data for Deletion and Updation

5) Use Temp Tables

July 7, 2021, 8:34 p.m.

How to write efficient SQL Queries

In development, writing the queries is not just important. It is also important to write efficient SQL queries. Efficient queries give faster results. When the SQL queries are optimized your application's faster performance saves a lot of time. 1) Use the exact number of columns 2) No need to count everything in the table 3) Avoid using DISTINCT keyword. 4) Create a small batches of Data for Deletion and Updation 5) Use Temp Tables

July 7, 2021, 8:34 p.m.

Blockchain

Blockchain is a decentralized system of secured and trusted distributed databases which records and shares the transaction details across many nodes. So, that the data is not modified.

"Structures that stores transactional records, also known as block, of the public in several databases, known as the chain in a network connected through peer to peer nodes."

July 3, 2021, 9:56 a.m.

Blockchain

Blockchain is a decentralized system of secured and trusted distributed databases which records and shares the transaction details across many nodes. So, that the data is not modified. "Structures that stores transactional records, also known as block, of the public in several databases, known as the chain in a network connected through peer to peer nodes."

July 3, 2021, 9:56 a.m.

Internet of Things

Internet of things is the concept of connecting any device to the internet and to other connected devices. The IOT is a giant network on connected thing and people - all of which collect and share data about the way they are used and about the environment around them.

"Connecting everyday things embedded with electronics software and sensors to the internet enabling them to collect and exchange data."

Eg. Smart microwaves- which automatically cook your food for the right length of time, Self driving cars whose complex sensors detect objects in their path.

July 1, 2021, 8:03 a.m.

Internet of Things

Internet of things is the concept of connecting any device to the internet and to other connected devices. The IOT is a giant network on connected thing and people - all of which collect and share data about the way they are used and about the environment around them. "Connecting everyday things embedded with electronics software and sensors to the internet enabling them to collect and exchange data." Eg. Smart microwaves- which automatically cook your food for the right length of time, Self driving cars whose complex sensors detect objects in their path.

July 1, 2021, 8:03 a.m.

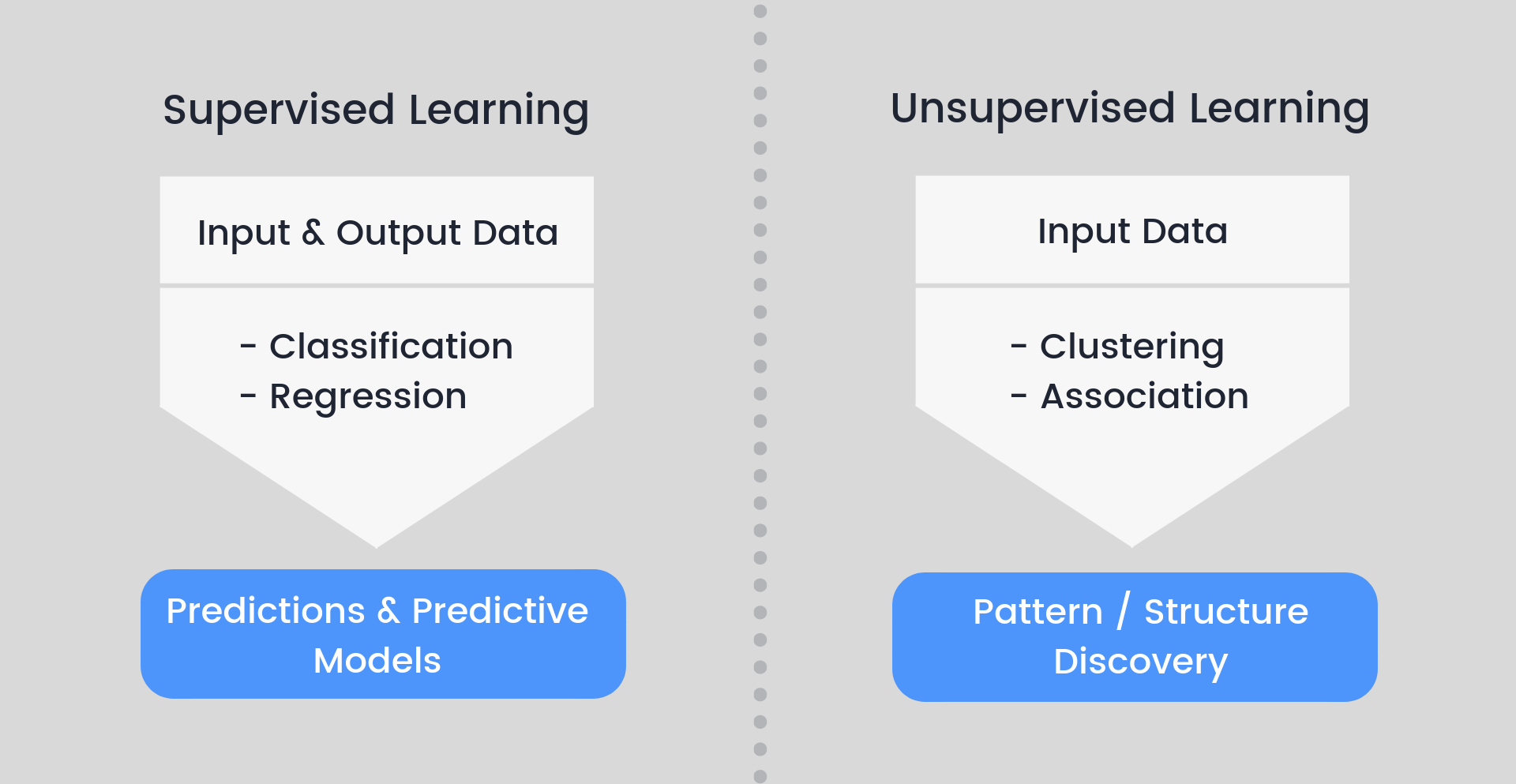

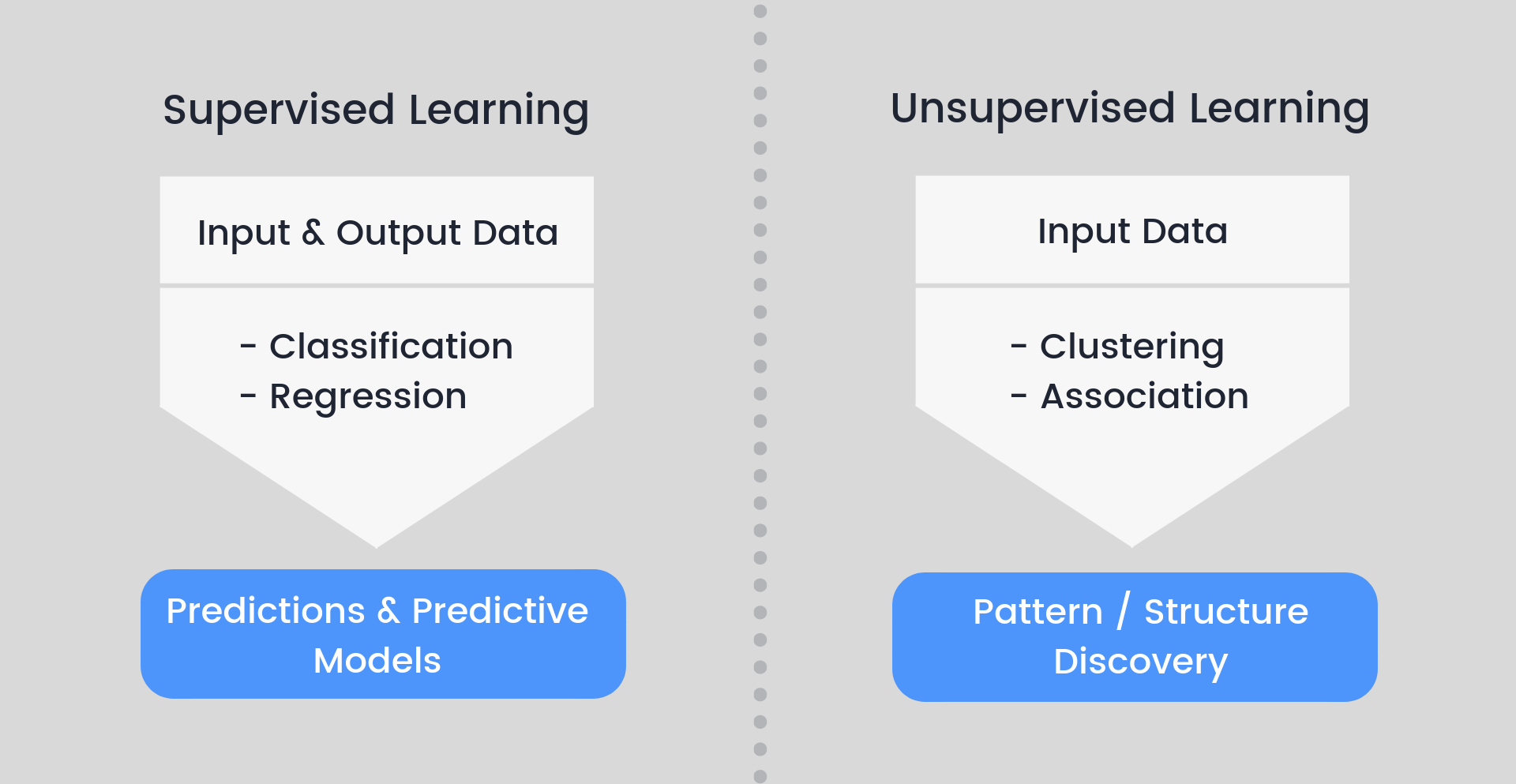

Supervised and Unsupervised Learning

Supervised learning is a technique in which we teach or train the machine using data which is well labelled.

Algo: Linear Regression, Logistic Regression

Unsupervised learning is the training of machine using information that is unlabeled and allowing the algorithm to act on that information without guidance.

Algo: K-means, C-means

June 30, 2021, 9:01 a.m.

Supervised and Unsupervised Learning

Supervised learning is a technique in which we teach or train the machine using data which is well labelled. Algo: Linear Regression, Logistic Regression Unsupervised learning is the training of machine using information that is unlabeled and allowing the algorithm to act on that information without guidance. Algo: K-means, C-means

June 30, 2021, 9:01 a.m.

Machine Learning

Machine Learning is a subset of Artificial Intelligence (AI) which provides machines the ability to learn automatically & improve from experience without being explicitly programmed.

Netflix recommendation are made by machine learning.

Need for machine Learning:

1) Increase in Data Generation

Because of excessive production of data we need a method that can be used to structure analyze and draw useful insight from data.

2) It improves decision making

By using various algorithm machine can be used to make better business decision for ex. to forecast sales it is used to predict any downfall in the stock market.

3) It uncover patterns & trends in data

Finding hidden patterns and extracting key insights from data is the most essential part of machine learning.

May 9, 2021, 9:39 p.m.

Machine Learning

Machine Learning is a subset of Artificial Intelligence (AI) which provides machines the ability to learn automatically & improve from experience without being explicitly programmed. Netflix recommendation are made by machine learning. Need for machine Learning: 1) Increase in Data Generation Because of excessive production of data we need a method that can be used to structure analyze and draw useful insight from data. 2) It improves decision making By using various algorithm machine can be used to make better business decision for ex. to forecast sales it is used to predict any downfall in the stock market. 3) It uncover patterns & trends in data Finding hidden patterns and extracting key insights from data is the most essential part of machine learning.

May 9, 2021, 9:39 p.m.

How to send emails using Python ?

Sending emails through programming languages like python has many use cases.

For example, you might want to send transactional emails.

April 3, 2021, 1:27 p.m.

How to send emails using Python ?

Sending emails through programming languages like python has many use cases. For example, you might want to send transactional emails. Use it to notify the user about their actions on your site. To send the newsletter of your subscribers. To send the invoices or order details of the recent orders.

April 3, 2021, 1:27 p.m.

Session

A session can be defined as a server side storage of information that is persist throughout the user interaction with the website or web application. We can store data in the browser of client machine to get the preferences of particular user.

March 10, 2021, 10:28 p.m.

How to customize Django Admin panel ?

1) Go to admin.py file

2) Create a class {modelname}Admin

3) admin.site.register({modelname}, {modelname}Admin)

4) Save and go to admin page of your application.

Feb. 21, 2021, 8:30 p.m.

How to customize Django Admin panel ?

1) Go to admin.py file 2) Create a class {modelname}Admin 3) admin.site.register({modelname}, {modelname}Admin) 4) Save and go to admin page of your application.

Feb. 21, 2021, 8:30 p.m.

SSH

(1)SSH stands for Secure Shell.

(2)It is a Method of securely communicating with another computer.

(3)All data sent via an SSH connection is encrypted (means if someone tries to intercept the information transferred it would appear in an unreadable format).

(4)SSH is based on Unix Shell, which is a program that interprets the command entered by user.

(5)Standard Unix command can be used to view, modify and transfer files once an SSH connection is established.

Feb. 17, 2021, 11:40 a.m.

SSH

(1)SSH stands for Secure Shell.

(2)It is a Method of securely communicating with another computer.

(3)All data sent via an SSH connection is encrypted (means if someone tries to intercept the information transferred it would appear in an unreadable format).

(4)SSH is based on Unix Shell, which is a program that interprets the command entered by user.

(5)Standard Unix command can be used to view, modify and transfer files once an SSH connection is established.

Feb. 17, 2021, 11:40 a.m.

API-Application Programming Interface

In Simple terms, API is a service which takes the request from the user put it in front of the server and gets response from the server and presents it to the user in the understandable format. It just act as a mediator to interact between two applications. Example: Uber using Google Maps API to pull out the location data.

Feb. 1, 2021, 5:28 p.m.

API-Application Programming Interface

In Simple terms, API is a service which takes the request from the user put it in front of the server and gets response from the server and presents it to the user in the understandable format. It just act as a mediator to interact between two applications. Example: Uber using Google Maps API to pull out the location data.

Feb. 1, 2021, 5:28 p.m.

Finance

Car Buying Rule 20-4-10-50

Are you planning to buy a car but worried about overspending or managing your finances? The 20/4/10/50 rule is the ultimate guide to buying your dream car without breaking the bank! 🚘

In this video, we explain:

✅ Why a 20% down payment is essential.

✅ The benefits of keeping your loan term within 4 years.

✅ How to calculate an EMI that fits within 10% of your income.

✅ Why your car's price shouldn't exceed 50% of your annual income.

We’ll break it down with relatable examples, perfect for Indian families planning their next big purchase.

Nov. 17, 2024, 7:31 a.m.

Car Buying Rule 20-4-10-50

Are you planning to buy a car but worried about overspending or managing your finances? The 20/4/10/50 rule is the ultimate guide to buying your dream car without breaking the bank! 🚘 In this video, we explain: ✅ Why a 20% down payment is essential. ✅ The benefits of keeping your loan term within 4 years. ✅ How to calculate an EMI that fits within 10% of your income. ✅ Why your car's price shouldn't exceed 50% of your annual income. We’ll break it down with relatable examples, perfect for Indian families planning their next big purchase.

Nov. 17, 2024, 7:31 a.m.

What is Tri-Party Repo?

This is not a tool of Monetary Policy. It helps Corporate to borrow money.

Feb. 9, 2021, 11:21 a.m.

What is Tri-Party Repo?

This is not a tool of Monetary Policy. It helps Corporate to borrow money.

Feb. 9, 2021, 11:21 a.m.

Price Earning ratio (P/E)

The price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings (EPS).

A high P/E ratio could mean that a company's stock is over-valued, or else that investors are expecting high growth rates in the future.

It signifies the amount of money an investor is willing to invest in a single share of a company for Re. 1 of its earnings.

For instance, if a company has a P/E Ratio of 40, investors are willing to pay Rs. 40 in its stocks for Re. 1 of their current earnings.

Feb. 4, 2021, 10:18 p.m.

Price Earning ratio (P/E)

The price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings (EPS).

A high P/E ratio could mean that a company's stock is over-valued, or else that investors are expecting high growth rates in the future.

It signifies the amount of money an investor is willing to invest in a single share of a company for Re. 1 of its earnings.

For instance, if a company has a P/E Ratio of 40, investors are willing to pay Rs. 40 in its stocks for Re. 1 of their current earnings.

Feb. 4, 2021, 10:18 p.m.

CASA - Current & Savings account ratio

CASA ratio stands for current and savings account ratio. CASA ratio of a bank is the ratio of deposits in current and saving accounts to total deposits. A higher CASA ratio indicates a lower cost of funds, because banks do not usually give any interests on current account deposits and the interest on saving accounts is usually very low 3-4%.

It is used as one of the metrics to assess the profitability of a bank.

HDFC Bank has highest CASA ratio in India followed by SBI.

Feb. 4, 2021, 10:12 p.m.

CASA - Current & Savings account ratio

CASA ratio stands for current and savings account ratio. CASA ratio of a bank is the ratio of deposits in current and saving accounts to total deposits. A higher CASA ratio indicates a lower cost of funds, because banks do not usually give any interests on current account deposits and the interest on saving accounts is usually very low 3-4%. It is used as one of the metrics to assess the profitability of a bank. HDFC Bank has highest CASA ratio in India followed by SBI.

Feb. 4, 2021, 10:12 p.m.

UPI-Unified Payment Interface

A UPI (UPI ID) can be considered as your Financial Address with the help of which you can send and receive money in your bank account round the clock even on public holidays.

All you need for doing a transaction is just a smartphone with internet, application for UPI(which can be your bank application) and a bank account linked with UPI ID

Feb. 1, 2021, 7:08 p.m.

UPI-Unified Payment Interface

A UPI (UPI ID) can be considered as your Financial Address with the help of which you can send and receive money in your bank account round the clock even on public holidays. All you need for doing a transaction is just a smartphone with internet, application for UPI(which can be your bank application) and a bank account linked with UPI ID

Feb. 1, 2021, 7:08 p.m.

Education

How to create data using read_html using pandas ?

Most centuries in ODI cricket. Creating dataset for kaggle using pandas.

I have used ESPN data for Centuries in ODI Cricket.

Dec. 10, 2022, 4:13 p.m.

Dashboard using Excel

Reading tracker using excel with pie chart and bar graph for visualisation. This dashboard is created using pivot, advance excel functions and macros.

Sept. 16, 2022, 8:38 a.m.

Dashboard using Excel

Reading tracker using excel with pie chart and bar graph for visualisation. This dashboard is created using pivot, advance excel functions and macros.

Sept. 16, 2022, 8:38 a.m.

Commerce

SLR-Statutory Liquid Ratio

As the name suggest Liquidity, It is that percentage of Total Deposits which Banks have to invest in liquid asset which are as follows:

(i)in cash or,

(ii)in gold or,

(iii)investment in securities issued by Central Government, State Government or any other securities approved by RBI.

Feb. 4, 2021, 2:16 p.m.

SLR-Statutory Liquid Ratio

As the name suggest Liquidity, It is that percentage of Total Deposits which Banks have to invest in liquid asset which are as follows: (i)in cash or, (ii)in gold or, (iii)investment in securities issued by Central Government, State Government or any other securities approved by RBI.

Feb. 4, 2021, 2:16 p.m.

CRR-Cash Reserve Ratio

CRR is a certain percentage of Total Deposits which the banks have to keep with RBI, means banks cannot lend this amount of money to borrowers. This is done so that if a depositor comes to withdraw money banks should have the amount with them to meet there withdrawl requirement.

Main Objective behind CRR is to meet some sort of liquid cash against depositors.

CRR is fixed by RBI and is changed from time to time.

Example : If there is a total deposit of 1000 with the bank and CRR is 3% then banks have to deposit Rs. 30 with the RBI, means bank cannot lend this much amount for loans

Feb. 4, 2021, 10:48 a.m.

CRR-Cash Reserve Ratio

CRR is a certain percentage of Total Deposits which the banks have to keep with RBI, means banks cannot lend this amount of money to borrowers. This is done so that if a depositor comes to withdraw money banks should have the amount with them to meet there withdrawl requirement. Main Objective behind CRR is to meet some sort of liquid cash against depositors. CRR is fixed by RBI and is changed from time to time. Example : If there is a total deposit of 1000 with the bank and CRR is 3% then banks have to deposit Rs. 30 with the RBI, means bank cannot lend this much amount for loans

Feb. 4, 2021, 10:48 a.m.

Reverse Repo Rate

Reverse Repo Rate is the rate at which comercial banks park their excess funds with the RBI.

Main Objective of this is to control the overall supply of money in the economy.

Higher the Reverse Repo Rate the supply of money decreases in the economy as the bank park their money with RBI.

Lower the Reverse Repo Rate the supply of money increases as banks lend more money to borrowers rather than depositing it with RBI.

Feb. 3, 2021, 6:05 p.m.

Reverse Repo Rate

Reverse Repo Rate is the rate at which comercial banks park their excess funds with the RBI. Main Objective of this is to control the overall supply of money in the economy. Higher the Reverse Repo Rate the supply of money decreases in the economy as the bank park their money with RBI. Lower the Reverse Repo Rate the supply of money increases as banks lend more money to borrowers rather than depositing it with RBI.

Feb. 3, 2021, 6:05 p.m.

Repo Rate

Repo Rate is the rate at which RBI lends money to banks in case of any shortfall in funds arises with the banks.

Impact on Borrower :

(1)Higher the Repo Rate : The loan becomes more expensive

(2)Lower the Repo Rate : The loan becomes cheaper

Feb. 3, 2021, 5:56 p.m.

Taxation

TCS- Tax Collected at source

Tax collected at source (TCS) is the tax payable by a seller which he collects from the buyer at the time of sale. Section 206C of the Income-tax act governs the goods on which the seller has to collect tax from the purchasers.

Types of goods on which Tcs is levied.

(i) Liquor

(ii) Tendu leaves

(iii) Timber wood

(iv) Forest produce

(v) Scrap

(vi) Motor vehicles

& few other items.

Feb. 17, 2021, 11:19 p.m.

TCS- Tax Collected at source

Tax collected at source (TCS) is the tax payable by a seller which he collects from the buyer at the time of sale. Section 206C of the Income-tax act governs the goods on which the seller has to collect tax from the purchasers.

Types of goods on which Tcs is levied.

(i) Liquor

(ii) Tendu leaves

(iii) Timber wood

(iv) Forest produce

(v) Scrap

(vi) Motor vehicles

& few other items.

Feb. 17, 2021, 11:19 p.m.

Deduction u/s 80 RRB - With Respect to Income Received by way of Royalty of a Patent

(1)Deduction for any Income by way of Royalty for a patent shall be available for up to Rs. 3 lakh or the Income received whichever is less.

(2)The Taxpayer must be an Indian Resident and an Individual Patentee.

(3)The Taxpayer must furnish a certificate in prescribed form duly signed by the prescribed authority.

Feb. 14, 2021, 2:23 p.m.

Deduction u/s 80 RRB - With Respect to Income Received by way of Royalty of a Patent

(1)Deduction for any Income by way of Royalty for a patent shall be available for up to Rs. 3 lakh or the Income received whichever is less.

(2)The Taxpayer must be an Indian Resident and an Individual Patentee.

(3)The Taxpayer must furnish a certificate in prescribed form duly signed by the prescribed authority.

Feb. 14, 2021, 2:23 p.m.

Deduction u/s 80 TTB - Deduction of Interest Income on Deposits for Senior Citizen

Under this section, a senior citizen will get a deduction of Rs.50,000 for Interest Income on deposits held by them in banks or post office.

Feb. 14, 2021, 1:25 p.m.

Deduction u/s 80 TTB - Deduction of Interest Income on Deposits for Senior Citizen

Under this section, a senior citizen will get a deduction of Rs.50,000 for Interest Income on deposits held by them in banks or post office.

Feb. 14, 2021, 1:25 p.m.

Deduction u/s 80GGC - Contributions given by individuals to political parties

This section is applicable for Individuals who contribute to any political party or any

electoral trust by any other way other than cash for any amount.

Feb. 14, 2021, 1:15 p.m.

Deduction u/s 80GGC - Contributions given by individuals to political parties

This section is applicable for Individuals who contribute to any political party or any

electoral trust by any other way other than cash for any amount.

Feb. 14, 2021, 1:15 p.m.

Deduction u/s 80GGB - Contributions given by companies to political parties

Under this section, Deduction is allowed to an Indian Company for any Contribution made to any political party or an electoral trust by any way other than Cash.

Feb. 14, 2021, 10:04 a.m.

Deduction u/s 80GGB - Contributions given by companies to political parties

Under this section, Deduction is allowed to an Indian Company for any Contribution made to any political party or an electoral trust by any way other than Cash.

Feb. 14, 2021, 10:04 a.m.

Deduction u/s 80E- Interest on Education Loan

In this Section deduction is allowed to an Individual for Interest on loan taken for pursuing Higher Education.

The Loan may be for Taxpayer himself, or for spouse, or children or for Student for whom the taxpayer is a legal guardian.

No Restriction on Amount that Can be Claimed.

Deduction is available for a maximum of 8 years period(beginning the year in which the interest starts getting repaid) or till the entire interest is repaid, whichever is earlier.

Feb. 14, 2021, 9:56 a.m.

Deduction u/s 80E- Interest on Education Loan

In this Section deduction is allowed to an Individual for Interest on loan taken for pursuing Higher Education.

The Loan may be for Taxpayer himself, or for spouse, or children or for Student for whom the taxpayer is a legal guardian.

No Restriction on Amount that Can be Claimed.

Deduction is available for a maximum of 8 years period(beginning the year in which the interest starts getting repaid) or till the entire interest is repaid, whichever is earlier.

Feb. 14, 2021, 9:56 a.m.

Deduction u/s 80 TTA - Interest on Savings Account

Under this Section you will get a deduction of Rs.10,000 against Interest Income on your Savings Bank Account if you are an Individual or HUF.

This Section is not applicable in case of Interest from Fixed Deposits, Recurring Deposits, or Interest Income form corporate bonds.

Feb. 14, 2021, 9:46 a.m.

Deduction u/s 80 TTA - Interest on Savings Account

Under this Section you will get a deduction of Rs.10,000 against Interest Income on your Savings Bank Account if you are an Individual or HUF.

This Section is not applicable in case of Interest from Fixed Deposits, Recurring Deposits, or Interest Income form corporate bonds.

Feb. 14, 2021, 9:46 a.m.

Income Under the Head Salary

Salary in simple terms means any amount paid by employer to his employees in lieu of services rendered by them.

Section 17(1) of Income Tax Act 1961 defines the term "Salary" which include the following monetary as well as non-monetary payments :

(a)Wages

(b)Annuity or Pension

(c)Any Gratuity

(d)Any Fees, Commission, perquisite or profits in lieu of or in addition to any salary or wages

(e)Advance of Salary

(f)Leave Encashment

(g)Employer contribution to provident fund in excess of 12% of salary

(h) Contribution by Central Government or any other employer to Employees Pension Account as referred in Sec. 80CCD

Feb. 13, 2021, 10:57 p.m.

Income Under the Head Salary

Salary in simple terms means any amount paid by employer to his employees in lieu of services rendered by them.

Section 17(1) of Income Tax Act 1961 defines the term "Salary" which include the following monetary as well as non-monetary payments :

(a)Wages

(b)Annuity or Pension

(c)Any Gratuity

(d)Any Fees, Commission, perquisite or profits in lieu of or in addition to any salary or wages

(e)Advance of Salary

(f)Leave Encashment

(g)Employer contribution to provident fund in excess of 12% of salary

(h) Contribution by Central Government or any other employer to Employees Pension Account as referred in Sec. 80CCD

Feb. 13, 2021, 10:57 p.m.

Form 15G and 15H

Banks Deducts TDS on your Interest Income when it is more than Rs.40,000 in a financial year(prior to FY 2019-20 this limit was Rs.10000).So as to prevent deduction of TDS if your total income is below the taxable limit you can submit form 15G/15H.

Main Objective of Form 15G and 15H is to prevent TDS deduction on your interest income.

Key Points related to Form 15G/15H :

(1)PAN is Compulsory

(2)Form 15H is for Senior Citizens who are 60 years and above.

(3)Form 15G is for Other Individuals or HUF but not for a company or a firm.

Feb. 11, 2021, 1:30 p.m.

Form 15G and 15H

Banks Deducts TDS on your Interest Income when it is more than Rs.40,000 in a financial year(prior to FY 2019-20 this limit was Rs.10000).So as to prevent deduction of TDS if your total income is below the taxable limit you can submit form 15G/15H.

Main Objective of Form 15G and 15H is to prevent TDS deduction on your interest income.

Key Points related to Form 15G/15H :

(1)PAN is Compulsory

(2)Form 15H is for Senior Citizens who are 60 years and above.

(3)Form 15G is for Other Individuals or HUF but not for a company or a firm.

Feb. 11, 2021, 1:30 p.m.

Deduction u/s 80CCE

According to section 80CCE, the maximum deduction that can be claimed u/s 80C, 80CCC, 80CCD(1) cannot exceed Rs150000.

However deduction u/s 80CCD(1B) of Rs50000 is not included in above limit.

Feb. 11, 2021, 10:12 a.m.

Deduction u/s 80CCE

According to section 80CCE, the maximum deduction that can be claimed u/s 80C, 80CCC, 80CCD(1) cannot exceed Rs150000.

However deduction u/s 80CCD(1B) of Rs50000 is not included in above limit.

Feb. 11, 2021, 10:12 a.m.

Form 26AS

It is basically an Annual Statement containing details about :

(i)Tax Deducted at Source,

(ii)Tax Collected by your Collectors,

(iii)Advance Tax Paid,

(iv)Information regarding high value transactions,

(v)Information regarding refund received.

(vi)Self Assessment Tax Payments

Feb. 10, 2021, 1:34 p.m.

Form 26AS

It is basically an Annual Statement containing details about :

(i)Tax Deducted at Source,

(ii)Tax Collected by your Collectors,

(iii)Advance Tax Paid,

(iv)Information regarding high value transactions,

(v)Information regarding refund received.

(vi)Self Assessment Tax Payments

Feb. 10, 2021, 1:34 p.m.

Form-16

Form-16 is a Certificate issued by an employer to employees which helps them in preparing and filing Income Tax Return. It has 2 Components:

(1)Part A : Components of Part A are:

(i)Name and Address of the Employer

(ii)Tan and Pan of the Employer

(iii)Pan of Employee

(iv)Summary of Tax deducted and deposited quarterly, which is certified by the Employer.

(2)Part B : Components of Part B are:

(i)Detailed Breakup of Salary

(ii)Detailed Breakup of Exempted Allowance

(iii)Details of Deductions Allowed Under Chapter VI-A

Feb. 10, 2021, 12:31 p.m.

Form-16

Form-16 is a Certificate issued by an employer to employees which helps them in preparing and filing Income Tax Return. It has 2 Components:

(1)Part A : Components of Part A are:

(i)Name and Address of the Employer

(ii)Tan and Pan of the Employer

(iii)Pan of Employee

(iv)Summary of Tax deducted and deposited quarterly, which is certified by the Employer.

(2)Part B : Components of Part B are:

(i)Detailed Breakup of Salary

(ii)Detailed Breakup of Exempted Allowance

(iii)Details of Deductions Allowed Under Chapter VI-A

Feb. 10, 2021, 12:31 p.m.

Deduction u/s 80CCD(2)

Employer’s contribution to NPS – Section 80CCD (2) Additional deduction is allowed for employer’s contribution to employee’s pension account of up to 10% of the salary of the employee.

Feb. 9, 2021, 4:52 p.m.

Deduction u/s 80CCD(2)

Employer’s contribution to NPS – Section 80CCD (2) Additional deduction is allowed for employer’s contribution to employee’s pension account of up to 10% of the salary of the employee.

Feb. 9, 2021, 4:52 p.m.

Deduction u/s 80CCD(1B)

Deduction for self-contribution to NPS – section 80CCD (1B) A new section 80CCD (1B) has been introduced for an additional deduction of up to Rs 50,000 for the amount deposited by a taxpayer to their NPS account. Contributions to Atal Pension Yojana are also eligible

Feb. 9, 2021, 4:51 p.m.

Deduction u/s 80CCD(1B)

Deduction for self-contribution to NPS – section 80CCD (1B) A new section 80CCD (1B) has been introduced for an additional deduction of up to Rs 50,000 for the amount deposited by a taxpayer to their NPS account. Contributions to Atal Pension Yojana are also eligible

Feb. 9, 2021, 4:51 p.m.

Deduction u/s 80CCD(1)

Employee’s contribution – Section 80CCD (1) is allowed to an individual who makes deposits to his/her pension account. Maximum deduction allowed is 10% of salary (in case the taxpayer is an employee) or 20% of gross total income (in case the taxpayer being self-employed) or Rs 1, 50,000, whichever is less.

Feb. 9, 2021, 4:48 p.m.

Deduction u/s 80CCD(1)

Employee’s contribution – Section 80CCD (1) is allowed to an individual who makes deposits to his/her pension account. Maximum deduction allowed is 10% of salary (in case the taxpayer is an employee) or 20% of gross total income (in case the taxpayer being self-employed) or Rs 1, 50,000, whichever is less.

Feb. 9, 2021, 4:48 p.m.

Deduction u/s 80CCC

Deduction for Premium Paid for Annuity Plan of LIC or Other Insurer

This section provides a deduction to an individual for any amount paid or deposited in any annuity plan of LIC or any other insurer. The plan must be for receiving a pension from a fund referred to in Section 10(23AAB). Pension received from the annuity or amount received upon surrender of the annuity, including interest or bonus accrued on the annuity, is taxable in the year of receipt.

Feb. 9, 2021, 4:46 p.m.

Deduction u/s 80CCC

Deduction for Premium Paid for Annuity Plan of LIC or Other Insurer

This section provides a deduction to an individual for any amount paid or deposited in any annuity plan of LIC or any other insurer. The plan must be for receiving a pension from a fund referred to in Section 10(23AAB). Pension received from the annuity or amount received upon surrender of the annuity, including interest or bonus accrued on the annuity, is taxable in the year of receipt.

Feb. 9, 2021, 4:46 p.m.

Deduction u/s 80C (Investments)

Section 80C of the Income Tax Act of India is a clause that points to various expenditures and investments that are exempted from Income tax. It allows for a maximum deduction of up to Rs.1.5 lakh every year from an investor’s total taxable income.

.

Feb. 9, 2021, 4:41 p.m.

Deduction u/s 80C (Investments)

Section 80C of the Income Tax Act of India is a clause that points to various expenditures and investments that are exempted from Income tax. It allows for a maximum deduction of up to Rs.1.5 lakh every year from an investor’s total taxable income. .

Feb. 9, 2021, 4:41 p.m.

Rebate u/s 87A of Income tax act

An income tax rebate can simply be understood as a form of refund on taxes that you receive from the Income Tax Dept.

Any individual with an annual taxable income of up to Rs 5 lakhs is eligible for an income tax rebate of Rs 12,500. This essentially translates to the fact that individuals with an annual income lower than Rs 5 lakhs are entirely exempted from income tax and can effectively save income tax in India.

Feb. 9, 2021, 4:32 p.m.

Rebate u/s 87A of Income tax act

An income tax rebate can simply be understood as a form of refund on taxes that you receive from the Income Tax Dept.

Any individual with an annual taxable income of up to Rs 5 lakhs is eligible for an income tax rebate of Rs 12,500. This essentially translates to the fact that individuals with an annual income lower than Rs 5 lakhs are entirely exempted from income tax and can effectively save income tax in India.

Feb. 9, 2021, 4:32 p.m.

TDS ( Tax deducted at source)

TDS stands for tax deducted at source. As per the Income Tax act, any company or person making a payment is required to deduct tax at source if the payment exceeds certain threshold limits. TDS has to be deducted at the rates prescribed by the tax department.

The types of payments on which TDS is applicable are:

- Salaries

- Interest income from financial institutions

- Commission payment

- Rent payment

- Professional fees

- Consultation fees

Feb. 9, 2021, 4:21 p.m.

TDS ( Tax deducted at source)

TDS stands for tax deducted at source. As per the Income Tax act, any company or person making a payment is required to deduct tax at source if the payment exceeds certain threshold limits. TDS has to be deducted at the rates prescribed by the tax department. The types of payments on which TDS is applicable are: Salaries Interest income from financial institutions Commission payment Rent payment Professional fees Consultation fees

Feb. 9, 2021, 4:21 p.m.

Exemption Vs Deduction

Income tax exemptions are provided on particular sources of income and not on the total income. It can also mean that you do not have to pay any tax for income coming from that source. For example, income from agriculture is exempted under tax.

Whereas, income tax deductions can be claimed on the gross total income. Certain specified investments and expenditure are considered to claim deductions. For example 80C, 80D, 80E etc

Feb. 9, 2021, 4:19 p.m.

Exemption Vs Deduction

Income tax exemptions are provided on particular sources of income and not on the total income. It can also mean that you do not have to pay any tax for income coming from that source. For example, income from agriculture is exempted under tax.

Whereas, income tax deductions can be claimed on the gross total income. Certain specified investments and expenditure are considered to claim deductions. For example 80C, 80D, 80E etc

Feb. 9, 2021, 4:19 p.m.

Exemption in Income Tax

A Particular Income Which is not included in Total tax liability is called an Income Tax Exemption. In general Section 10 of Income Tax Act covers all the exemptions. Whereas, Section 54 Covers Exemption for Capital Gains arising on transfer of Residential House.

Some Examples of Income Tax Exemptions are : House Rent Allowance,Leave Travel Allowance,Long Term Capital Gain on Equity fund.

Feb. 9, 2021, 1:33 p.m.

Exemption in Income Tax

A Particular Income Which is not included in Total tax liability is called an Income Tax Exemption. In general Section 10 of Income Tax Act covers all the exemptions. Whereas, Section 54 Covers Exemption for Capital Gains arising on transfer of Residential House.

Some Examples of Income Tax Exemptions are : House Rent Allowance,Leave Travel Allowance,Long Term Capital Gain on Equity fund.

Feb. 9, 2021, 1:33 p.m.

Deductions in Income Tax

Deductions reduces your Gross Income Chargeable to Tax. In short these are those amounts which reduces your Tax Liability.

Sum of All heads of Income = Gross Income - Deductions = Taxable Income

All the Deductions are mentioned in Section 80 of Income Tax Act (Section 80C to 80U).

Feb. 9, 2021, 12:39 p.m.

Deductions in Income Tax

Deductions reduces your Gross Income Chargeable to Tax. In short these are those amounts which reduces your Tax Liability. Sum of All heads of Income = Gross Income - Deductions = Taxable Income All the Deductions are mentioned in Section 80 of Income Tax Act (Section 80C to 80U).

Feb. 9, 2021, 12:39 p.m.

Sources of Income

Different Sources of Income for which you need to pay tax are :

(1)Income from Salary : All the money received from your employer while rendering your job comes under the head income from salary.

(2)Income from House Property : Rent income from house or building.

(3)Income from Capital Gain : Gain or loss arising out of selling a capital asset.

(4)Income from Business/Profession : Income or loss arising as a result of carrying Business.

(5)Income from Other Sources : Interest on Savings A/c,Fixed Deposits,Gifts received

Feb. 9, 2021, 12:23 p.m.

Sources of Income

Different Sources of Income for which you need to pay tax are : (1)Income from Salary : All the money received from your employer while rendering your job comes under the head income from salary. (2)Income from House Property : Rent income from house or building. (3)Income from Capital Gain : Gain or loss arising out of selling a capital asset. (4)Income from Business/Profession : Income or loss arising as a result of carrying Business. (5)Income from Other Sources : Interest on Savings A/c,Fixed Deposits,Gifts received

Feb. 9, 2021, 12:23 p.m.

Previous Year and Assessment Year

Previous Year is basically the year for which you pay the tax.It is a 12 month period that starts from 1st April to 31st March.It is also called as financial year or tax year.

Assessment Year is the year in which you file the return for previous year.

Example: For Your Previous Year Starting from 1st April 2020 to 31st March 2021 Assessment Year is AY 2021-2022

Feb. 9, 2021, 11:27 a.m.

Previous Year and Assessment Year

Previous Year is basically the year for which you pay the tax.It is a 12 month period that starts from 1st April to 31st March.It is also called as financial year or tax year. Assessment Year is the year in which you file the return for previous year. Example: For Your Previous Year Starting from 1st April 2020 to 31st March 2021 Assessment Year is AY 2021-2022

Feb. 9, 2021, 11:27 a.m.

Filing of belated return without fees

Forgot to file your return & Now worrying about paying fees.

Don't worry ,We have a tip for you.

If your total income doesn't exceed Rs250000 you can still file return without paying fee & interest.

Feb. 2, 2021, 11:20 p.m.

Investment

NPS - National Pension Scheme

(1)NPS is basically a scheme in which an investment is done regularly during the employment period of an employee to receive a regular amount of Income after the retirement.

(2)Eligibility : Employees from public, private and unorganized sectors except those from armed forces, can open an account under this scheme.

(3)Investment in NPS is eligible for deduction u/s 80C of Income Tax Act 1961.

(4)Offers a good return over other schemes like PPF and so far has delivered 8% to 10% and hence a low risk investment option.

(5)You can withdraw a certain amount of corpus, from the rest amount you will receive a monthly pension.

(6)Managed by PFRDA - Pension Fund Regulatory and Development Authority.

(7)It is now possible to open an NPS account online, if you link your account to your PAN, Aadhaar and mobile number. You can validate the registration using the OTP sent to your mobile. This will generate a PRAN (Permanent Retirement Account Number), which you can use for NPS login.

Feb. 19, 2021, 10:33 p.m.

NPS - National Pension Scheme

(1)NPS is basically a scheme in which an investment is done regularly during the employment period of an employee to receive a regular amount of Income after the retirement.

(2)Eligibility : Employees from public, private and unorganized sectors except those from armed forces, can open an account under this scheme.

(3)Investment in NPS is eligible for deduction u/s 80C of Income Tax Act 1961.

(4)Offers a good return over other schemes like PPF and so far has delivered 8% to 10% and hence a low risk investment option.

(5)You can withdraw a certain amount of corpus, from the rest amount you will receive a monthly pension.

(6)Managed by PFRDA - Pension Fund Regulatory and Development Authority.

(7)It is now possible to open an NPS account online, if you link your account to your PAN, Aadhaar and mobile number. You can validate the registration using the OTP sent to your mobile. This will generate a PRAN (Permanent Retirement Account Number), which you can use for NPS login.

Feb. 19, 2021, 10:33 p.m.

Systematic Transfer Plan (STP)

Key Points :

(1)As the name suggest, Transfer - It is a systematic transfer of funds from one plan to another instantaneously and without any hassles.

(2)This Transfer occurs periodically and hence helps an investor to gain market advantage by shifting to securities that offer a higher return.

(3)It helps an investors during market fluctuations to minimize the loss.

(4)Funds can only be transferred to other schemes which are managed under the same Asset Management Companies(AMC), means inter shifting b/w various schemes offered by different AMC's are not allowed.

(5)Types of STP :

(i) Flexible STP : the amount to be transferred are decided by the investor as and when the need arises.

(ii) Fixed STP : Total amount to be transferred is decided by the investor and it remains fixed.

(iii)Capital systematic transfer plans : transfer the capital gain of a fund to another fund with a high potential for growth.

Feb. 17, 2021, 10:10 p.m.

Systematic Transfer Plan (STP)

Key Points :

(1)As the name suggest, Transfer - It is a systematic transfer of funds from one plan to another instantaneously and without any hassles.

(2)This Transfer occurs periodically and hence helps an investor to gain market advantage by shifting to securities that offer a higher return.

(3)It helps an investors during market fluctuations to minimize the loss.

(4)Funds can only be transferred to other schemes which are managed under the same Asset Management Companies(AMC), means inter shifting b/w various schemes offered by different AMC's are not allowed.

(5)Types of STP :

(i) Flexible STP : the amount to be transferred are decided by the investor as and when the need arises.

(ii) Fixed STP : Total amount to be transferred is decided by the investor and it remains fixed.

(iii)Capital systematic transfer plans : transfer the capital gain of a fund to another fund with a high potential for growth.

Feb. 17, 2021, 10:10 p.m.

Demat Account

Demat Account is an account that is used to hold shares and securities in electronic format. The full form of Demat account is a dematerialised account.

During online trading, shares are bought and held in a Demat account, thus facilitating easy trade for the users.

In India, Demat account service is provided by depositories such as NSDL and CDSL through intermediaries / Depository Participant / Stock Broker . The charges of Demat account vary as per the volume held in the account, type subscribed, and the terms and conditions laid by the depository and the stock broker.

Feb. 17, 2021, 9:31 p.m.

Demat Account

Demat Account is an account that is used to hold shares and securities in electronic format. The full form of Demat account is a dematerialised account.

During online trading, shares are bought and held in a Demat account, thus facilitating easy trade for the users.

In India, Demat account service is provided by depositories such as NSDL and CDSL through intermediaries / Depository Participant / Stock Broker . The charges of Demat account vary as per the volume held in the account, type subscribed, and the terms and conditions laid by the depository and the stock broker.

Feb. 17, 2021, 9:31 p.m.

Gold ETF or Exchange Traded Fund

Key Points of Gold ETF's :

(1)They are Just like stocks and are traded similarly on stock exchange.

(2)They are Commodity based Mutual Funds that invests in assets like Gold.

(3)When investor invest in these funds they are credited with unit's equivalent in cash instead of actual gold.

(4)No Risk of theft and a better option then holding the physical gold.

(5)No Extra Cost of Purchasing and selling as in the case of physical gold.

(6)Gold ETF's charges only 0.5% to 1% brokerage.

Feb. 17, 2021, 10:59 a.m.

Gold ETF or Exchange Traded Fund

Key Points of Gold ETF's :

(1)They are Just like stocks and are traded similarly on stock exchange.

(2)They are Commodity based Mutual Funds that invests in assets like Gold.

(3)When investor invest in these funds they are credited with unit's equivalent in cash instead of actual gold.

(4)No Risk of theft and a better option then holding the physical gold.

(5)No Extra Cost of Purchasing and selling as in the case of physical gold.

(6)Gold ETF's charges only 0.5% to 1% brokerage.

Feb. 17, 2021, 10:59 a.m.

Sovereign Gold Bonds (SGB)

Key Points of SGB :

(1)Alternative for Investors investing in GOLD in physical Form.

(2)Under this scheme gold is held in electronic form so no risk of theft.

(3)Long term Investment Option and has low risk as it is backed by government of India.

(4)Lock-in period of 8 years you also have the option to exit after 5 years.

(5)Guaranteed Annual Interest of 2.5% which is taxable but a better option than holding physical gold which doesn't earn any interest.

(6)Capital Gains are exempted from Income Tax if redeemed after maturity, a plus point of holding gold in this form.

(7)Can be used as a collateral for getting Loan from Banks.

(8)The Government sells these bonds through banks, Stock Holding Corporation of India limited and selected post office.

Feb. 17, 2021, 9:56 a.m.

Sovereign Gold Bonds (SGB)

Key Points of SGB :

(1)Alternative for Investors investing in GOLD in physical Form.

(2)Under this scheme gold is held in electronic form so no risk of theft.

(3)Long term Investment Option and has low risk as it is backed by government of India.

(4)Lock-in period of 8 years you also have the option to exit after 5 years.

(5)Guaranteed Annual Interest of 2.5% which is taxable but a better option than holding physical gold which doesn't earn any interest.

(6)Capital Gains are exempted from Income Tax if redeemed after maturity, a plus point of holding gold in this form.

(7)Can be used as a collateral for getting Loan from Banks.

(8)The Government sells these bonds through banks, Stock Holding Corporation of India limited and selected post office.

Feb. 17, 2021, 9:56 a.m.

PPF-Public Provident Fund

Major Attractions of PPF :

(1)Risk Free Investment Instrument.

(2)Helps to create Retirement corpus and hence a long term investment instrument.

(3)Interest Earned and the Returns are not taxable.

(4)Deduction of Maximum Rs.1,50,000 is allowed under section 80C of Income Tax Act for Investment made in PPF.

Feb. 14, 2021, 6:28 p.m.

PPF-Public Provident Fund

Major Attractions of PPF :

(1)Risk Free Investment Instrument.

(2)Helps to create Retirement corpus and hence a long term investment instrument.

(3)Interest Earned and the Returns are not taxable.

(4)Deduction of Maximum Rs.1,50,000 is allowed under section 80C of Income Tax Act for Investment made in PPF.

Feb. 14, 2021, 6:28 p.m.

Book Review

Atomic Habits

The secret of getting results that last is to never stop making improvements. It's remarkable what you can build if you just don't stop. It's remarkable the business you can build if you don't stop working. It's remarkable the body you can build if you don't stop training. It's remarkable the knowledge you can build if you don't sop learning. Small habits don't add up. They compound.

That's the power of atomic habits. Tiny changes. Remarkable results.

April 14, 2022, 10:11 a.m.

Atomic Habits

The secret of getting results that last is to never stop making improvements. It's remarkable what you can build if you just don't stop. It's remarkable the business you can build if you don't stop working. It's remarkable the body you can build if you don't stop training. It's remarkable the knowledge you can build if you don't sop learning. Small habits don't add up. They compound. That's the power of atomic habits. Tiny changes. Remarkable results.

April 14, 2022, 10:11 a.m.

Mint Your Money - An Easy Manual to Unlocking your Wealth-Creating Potential

Mint your Money is not just a book, it's a spell of simple financial wisdom for you. Reading this book will help you improve your financial decision-making and take simple small steps in life that can make a huge positive difference later on.

In this personal finance guide, seasoned value investor Pranjal Kamra discusses focused and practical ways of not just managing but growing your money.

Whether you've just started working or are already retired, whether you're raking in money or barely getting by, you can(and need to) secure your financial future.

April 3, 2021, 5:47 p.m.

Mint Your Money - An Easy Manual to Unlocking your Wealth-Creating Potential

Mint your Money is not just a book, it's a spell of simple financial wisdom for you. Reading this book will help you improve your financial decision-making and take simple small steps in life that can make a huge positive difference later on. In this personal finance guide, seasoned value investor Pranjal Kamra discusses focused and practical ways of not just managing but growing your money. Whether you've just started working or are already retired, whether you're raking in money or barely getting by, you can(and need to) secure your financial future.

April 3, 2021, 5:47 p.m.

Investonomy-The Stock Market Guide That Makes You Rich

(1) Investonomy is an initiative to empower existing as well potential investors.

(2)Not only explains modern value investing principles but also unveils certain secrets of Stock Market.

(3)It bursts popular myths and misconceptions about the Stock Market.

(4)Investonomy aims to tell you the means as to how you can make substantial money from the stock market with the right intent of investment.

This book is a road map for fuelling your ambitions and chasing the passion through your veins.

April 3, 2021, 3:49 p.m.

Investonomy-The Stock Market Guide That Makes You Rich

(1) Investonomy is an initiative to empower existing as well potential investors. (2)Not only explains modern value investing principles but also unveils certain secrets of Stock Market. (3)It bursts popular myths and misconceptions about the Stock Market. (4)Investonomy aims to tell you the means as to how you can make substantial money from the stock market with the right intent of investment. This book is a road map for fuelling your ambitions and chasing the passion through your veins.

April 3, 2021, 3:49 p.m.

Life's Amazing Secret

Selected Quotes from the Book:

1) We must have a positive state of mind when dealing with problems.

2) Being positive does not mean we neglect the negative. We must constructively deal with negative situation whilst simultaneously focusing on the positive.

3) Just like our tounge can be obsessed with something stuck in our teeth, our mind has a default setting to be obsessed about the negative.

March 28, 2021, 11:20 p.m.

Life's Amazing Secret

Selected Quotes from the Book: 1) We must have a positive state of mind when dealing with problems. 2) Being positive does not mean we neglect the negative. We must constructively deal with negative situation whilst simultaneously focusing on the positive. 3) Just like our tounge can be obsessed with something stuck in our teeth, our mind has a default setting to be obsessed about the negative.

March 28, 2021, 11:20 p.m.

B2B Back to Basics

Selected lines from B2B:

1) Instead of increasing their income to accommodate the size of their dreams, most people deflate their dreams to accommodate the size of their income.

2) Focus on the finish line, not the hurdles.

3) Hurdles are designed for jumping.

March 21, 2021, 11:22 p.m.

B2B Back to Basics

Selected lines from B2B: 1) Instead of increasing their income to accommodate the size of their dreams, most people deflate their dreams to accommodate the size of their income. 2) Focus on the finish line, not the hurdles. 3) Hurdles are designed for jumping.

March 21, 2021, 11:22 p.m.

Rich Dad Poor Dad

Selected quotes from the book:

1) My brain gets stronger everyday because I exercise it.

2) True learning takes energy, passion, a burning desire.

3) An intelligent person hires people who are more intelligent than they are.

March 10, 2021, 11:01 p.m.

Miscellaneous

How to use cutout in VN editor?

You can easily use cutout feature to create content for your social media handles.

Oct. 2, 2023, 7:54 a.m.

How to use cutout in VN editor?

You can easily use cutout feature to create content for your social media handles.

Oct. 2, 2023, 7:54 a.m.

How to create YouTube shorts?

Creating YouTube Shorts is a straightforward process. YouTube Shorts are short-form vertical videos, usually up to 60 seconds in length, that are designed for quick and engaging content. Here's how you can create YouTube Shorts:

Oct. 1, 2023, 7:39 a.m.

How to create YouTube shorts?

Creating YouTube Shorts is a straightforward process. YouTube Shorts are short-form vertical videos, usually up to 60 seconds in length, that are designed for quick and engaging content. Here's how you can create YouTube Shorts:

Oct. 1, 2023, 7:39 a.m.

Data Leak

Use your_email_id+website@gmail.com

Oct. 18, 2022, 9:01 a.m.

Data Leak

Use your_email_id+website@gmail.com

Oct. 18, 2022, 9:01 a.m.

Some useful websites

Useful websites like:

1. Cheatsheet for developers.

2. To convert your LinkedIn or twitter post in a screenshot.

3. SEO Tool

4. PDF Tool

5. Transparent Images

6. Auto draw

Jan. 22, 2022, 11:40 p.m.

Some useful websites

Useful websites like:

1. Cheatsheet for developers.

2. To convert your LinkedIn or twitter post in a screenshot.

3. SEO Tool

4. PDF Tool

5. Transparent Images

6. Auto draw

Jan. 22, 2022, 11:40 p.m.

Free Stock Photo and Videos Website

Top Five Free Stock Photos and Videos Website :

June 20, 2021, 4:20 p.m.

Free Stock Photo and Videos Website

Top Five Free Stock Photos and Videos Website :

June 20, 2021, 4:20 p.m.

About TAS

(1)TAS Stands for TATA ADMINISTRATIVE SERVICE.

(2)TAS is a Tata Group flagship leadership program for campus as well as for Tata Group employee.

(3)Both the Categories have their own eligibility criteria and timelines for applying.

(4)Future Prospects of a TAS Manager - After successful completion of induction programme, TAS managers are placed in Tata group companies for an accelerated career growth across Tata Group Companies.

March 25, 2021, 12:28 p.m.

About TAS

(1)TAS Stands for TATA ADMINISTRATIVE SERVICE.

(2)TAS is a Tata Group flagship leadership program for campus as well as for Tata Group employee.

(3)Both the Categories have their own eligibility criteria and timelines for applying.

(4)Future Prospects of a TAS Manager - After successful completion of induction programme, TAS managers are placed in Tata group companies for an accelerated career growth across Tata Group Companies.

March 25, 2021, 12:28 p.m.

Coding

Analysis of Opening pair in IPL 2024

Doing the analysis of Best Opening pair using Topsis Method. Determining the best opening partnership pair in T20 cricket involves considering several key parameters. Here are some important factors along with their ratings:

May 9, 2024, 10:05 a.m.

Introduction to Python

New to coding? No problem! This beginner-friendly Python tutorial covers print statement in python. Dive into Python programming with ease and start your coding journey today! Don't forget to subscribe for more helpful tutorials. Let's code!

April 11, 2024, 6:41 p.m.

Introduction to Python

New to coding? No problem! This beginner-friendly Python tutorial covers print statement in python. Dive into Python programming with ease and start your coding journey today! Don't forget to subscribe for more helpful tutorials. Let's code!

April 11, 2024, 6:41 p.m.

Kaun Banega Crorepati Simaulation using Python

KBC

1. Questions with options

2. Take home money

3. Threshold value of money

4. Display correct answer in case of user quit or wrong answer.

5. Ask for options again if answer format is not correct.

Nov. 23, 2023, 3:12 p.m.

Kaun Banega Crorepati Simaulation using Python

KBC 1. Questions with options 2. Take home money 3. Threshold value of money 4. Display correct answer in case of user quit or wrong answer. 5. Ask for options again if answer format is not correct.

Nov. 23, 2023, 3:12 p.m.

Lists | Python

List is versatile data type available in Python. It is a sequence in which elements are written as a list of comma-separated values (items) between square brackets.

The key feature of a list is that it can have elements belong to different data types.

Nov. 23, 2023, 6:42 a.m.

Learn Python

Replit to Learn Python

Oct. 29, 2023, 1:26 p.m.

How to send a Message using Telegram bot ?

Steps:

1. Search BotFather in Telegram

2. Create a newbot

3. Follow the instructions

4. Copy API Token

Oct. 29, 2022, 10:17 a.m.

How to send a Message using Telegram bot ?

Steps: 1. Search BotFather in Telegram 2. Create a newbot 3. Follow the instructions 4. Copy API Token

Oct. 29, 2022, 10:17 a.m.

Filter(), map() and reduce()

Filter(): The filter() function construct a list from those elements of the list for which a functions return True.

The filter() function returns True or False.

Note: it is recommended to use list comprehensions instead of these functions where possible.

Oct. 1, 2022, 8:02 a.m.

Filter(), map() and reduce()

Filter(): The filter() function construct a list from those elements of the list for which a functions return True.

The filter() function returns True or False.

Note: it is recommended to use list comprehensions instead of these functions where possible.

Oct. 1, 2022, 8:02 a.m.

Variable length arguments in Python

In some situations, it is not known in advance how many arguments will be passed to a function. In such cases, Python allows programmers to make function calls with arbitrary (or any) number of arguments. When we use arbitrary arguments or variable-length arguments, then the function definition uses an asterisk(*) before the parameter name.

Sept. 28, 2022, 7:48 a.m.

Variable length arguments in Python

In some situations, it is not known in advance how many arguments will be passed to a function. In such cases, Python allows programmers to make function calls with arbitrary (or any) number of arguments. When we use arbitrary arguments or variable-length arguments, then the function definition uses an asterisk(*) before the parameter name.

Sept. 28, 2022, 7:48 a.m.

File Handling in Python

A file is basically used because real life applications involve large amounts of data and in such situations we cannot expect those data to be stored in a variable.

In order to use files, we have to learn file input and output operation, that is, how data is read or written to a file. We first open a file, read or write to it, and then finally close it.

Sept. 24, 2022, 11:15 a.m.

File Handling in Python

A file is basically used because real life applications involve large amounts of data and in such situations we cannot expect those data to be stored in a variable. In order to use files, we have to learn file input and output operation, that is, how data is read or written to a file. We first open a file, read or write to it, and then finally close it.

Sept. 24, 2022, 11:15 a.m.

Triggers in PL/SQL

Triggers are stored programs, which are automatically executed or fired when some event occur. Events like:

1) A database manipulation (DELETE,INSERT,UPDATE)

2) A database definition (DROP, CREATE, ALTER)

3) A database operation (LOGON, LOGOFF, STARTUP, SHUTDOWN)

Triggers can be defined on the table, view schema or database with which the event is associated.

March 26, 2022, 2:03 p.m.

Triggers in PL/SQL

Triggers are stored programs, which are automatically executed or fired when some event occur. Events like: 1) A database manipulation (DELETE,INSERT,UPDATE) 2) A database definition (DROP, CREATE, ALTER) 3) A database operation (LOGON, LOGOFF, STARTUP, SHUTDOWN) Triggers can be defined on the table, view schema or database with which the event is associated.

March 26, 2022, 2:03 p.m.

Difference between Triggers and Procedures ?

Stored procedure can take input parameters, but we can't pass parameters as input to a trigger.

Stored procedure can return values but a trigger cannot return a value.

March 6, 2022, 2:20 p.m.

Difference between Triggers and Procedures ?

Stored procedure can take input parameters, but we can't pass parameters as input to a trigger.

Stored procedure can return values but a trigger cannot return a value.

March 6, 2022, 2:20 p.m.

What is Big O ?

In simple terms, Big O is basically a measure to find out how efficient an algorithm is.

It is a standard mathematical notation that determines the efficiency of an algorithm in worst case scenario.

For this we need to consider 2 things :

(i)Time Complexity : How much time does an algorithm took to complete ?

(ii)Space Complexity : How much space does an algorithm utilise ?

It Captures the upper bound to show how much space or time an algorithm may take in worst case scenario.

It is Usually written as :

F(n)=O(input size)

Feb. 6, 2022, 7:45 p.m.

What is Big O ?

In simple terms, Big O is basically a measure to find out how efficient an algorithm is.

It is a standard mathematical notation that determines the efficiency of an algorithm in worst case scenario.

For this we need to consider 2 things :

(i)Time Complexity : How much time does an algorithm took to complete ?

(ii)Space Complexity : How much space does an algorithm utilise ?

It Captures the upper bound to show how much space or time an algorithm may take in worst case scenario.

It is Usually written as :

F(n)=O(input size)

Feb. 6, 2022, 7:45 p.m.

Data Structure - Stack

Stack is a linear data structure and it follows last in first out principle(LIFO).

Which means the last inserted item is popped out first and then the other and so on.

You will get a clear picture of what stack exactly is by looking at the picture present with this article. Here 3 boxes are stacked up the upper one will be the first one to be popped out in order to reach the last box which is first inserted in this stack.

Feb. 6, 2022, 7:13 p.m.

Data Structure - Stack

Stack is a linear data structure and it follows last in first out principle(LIFO). Which means the last inserted item is popped out first and then the other and so on. You will get a clear picture of what stack exactly is by looking at the picture present with this article. Here 3 boxes are stacked up the upper one will be the first one to be popped out in order to reach the last box which is first inserted in this stack.

Feb. 6, 2022, 7:13 p.m.

Binary Search Tree

A tree is recursively defined as a set of one or more nodes where one is designated as the root of the tree.

A binary tree is a data structure that is defined as a collection of elements called nodes. In a binary tree, the topmost element is called the root node, and each node has 0, 1 or at the most 2 children.

Jan. 26, 2022, 9:47 a.m.

Binary Search Tree

A tree is recursively defined as a set of one or more nodes where one is designated as the root of the tree. A binary tree is a data structure that is defined as a collection of elements called nodes. In a binary tree, the topmost element is called the root node, and each node has 0, 1 or at the most 2 children.

Jan. 26, 2022, 9:47 a.m.

Insertion Sort

Insertion sort is another O(N2) quadratic running time algorithm.

On large data set it is very inefficient but on array with 10-20 items it is quite good.

Stable sorting algorithm: which maintains the relative order of items with equal values.

In place algorithm : does not need any additional memory.

Jan. 15, 2022, 1:57 p.m.

Insertion Sort

Insertion sort is another O(N2) quadratic running time algorithm.

On large data set it is very inefficient but on array with 10-20 items it is quite good.

Stable sorting algorithm: which maintains the relative order of items with equal values.

In place algorithm : does not need any additional memory.

Jan. 15, 2022, 1:57 p.m.

Python itertools

Let's suppose there are two lists and you want to add their elements and at last index you will find the sum of all elements. You can also check max and min at a particular index. You can do it using a for loop, using map function or an efficient way of doing it is using itertools. Python provides various functions that works on iterators.

May 26, 2021, 6:43 p.m.

Python itertools

Let's suppose there are two lists and you want to add their elements and at last index you will find the sum of all elements. You can also check max and min at a particular index. You can do it using a for loop, using map function or an efficient way of doing it is using itertools. Python provides various functions that works on iterators.

May 26, 2021, 6:43 p.m.

How to extract data from API (Co-win Public API) using Python?

In basic terms, API just allow applications to communicate with one another.

Web based API is an extensible framework for building HTTP based services that can be accessed in different applications on different platforms such as web, windows, mobile etc.

May 16, 2021, 8:55 p.m.

How to extract data from API (Co-win Public API) using Python?

In basic terms, API just allow applications to communicate with one another. Web based API is an extensible framework for building HTTP based services that can be accessed in different applications on different platforms such as web, windows, mobile etc.

May 16, 2021, 8:55 p.m.

String formatting in Python

There are three ways for string formatting in Python:

1) .format()

2) Using template

3) Using template with dictionary

May 13, 2021, 10 p.m.

String formatting in Python

There are three ways for string formatting in Python:

1) .format()

2) Using template

3) Using template with dictionary

May 13, 2021, 10 p.m.

Linear Search

Linear Search is a very simple method for searching an array for a particular value. It works by comparing the value to be searched with every element of array one by one in a sequence until a match is found.

Linear search is mostly used to search an unordered list of elements.

May 12, 2021, 8:47 p.m.

Linear Search

Linear Search is a very simple method for searching an array for a particular value. It works by comparing the value to be searched with every element of array one by one in a sequence until a match is found.

Linear search is mostly used to search an unordered list of elements.

May 12, 2021, 8:47 p.m.

Bubble Sort Algorithm

1) Bubble sort repeatedly steps through the list to be sorted compares each pair of adjacent items and swps them if they are in wrong order.

2) It is too slow and impractical for most problems even when compared to insertion sort.

3) Worst case & Average Case time complexity in O(N2)

4) Not a practical sorting algorithm.

5) In computer graphics it can detect a very small error.

6) Stable sorting algorithm.

May 9, 2021, 4:37 p.m.

Bubble Sort Algorithm

1) Bubble sort repeatedly steps through the list to be sorted compares each pair of adjacent items and swps them if they are in wrong order. 2) It is too slow and impractical for most problems even when compared to insertion sort. 3) Worst case & Average Case time complexity in O(N2) 4) Not a practical sorting algorithm. 5) In computer graphics it can detect a very small error. 6) Stable sorting algorithm.

May 9, 2021, 4:37 p.m.

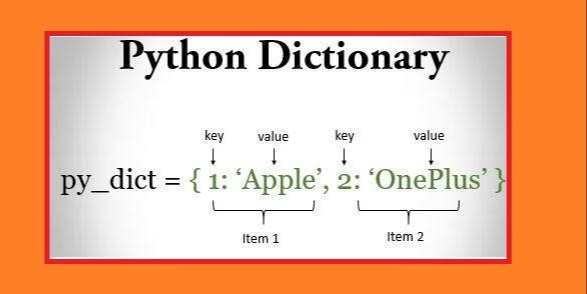

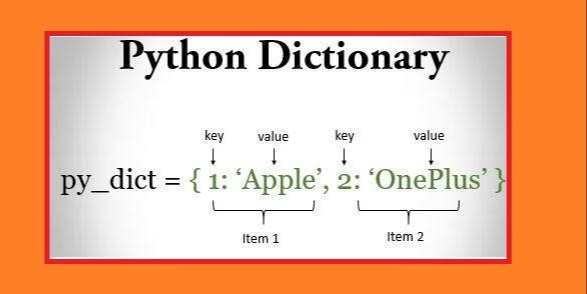

How to convert two lists into a dictionary ?

Create an empty dictionary, then using two for loops You can insert data into the dictionary consider first list as a key and another as its value. In this way, you can create a dictionary using two lists or you can use zip function to do it.

May 7, 2021, 4:07 p.m.

How to convert two lists into a dictionary ?

Create an empty dictionary, then using two for loops You can insert data into the dictionary consider first list as a key and another as its value. In this way, you can create a dictionary using two lists or you can use zip function to do it.

May 7, 2021, 4:07 p.m.

Binary Search

Binary search is a searching algorithm that works efficiently with a sorted list.

Search a sorted array by repeatedly dividing the search interval in half. Begin with an interval covering the whole array.

If the value of the search key is less than the item in the middle of the interval, narrow the interval to the lower half. Otherwise narrow it to the upper half.

May 1, 2021, 6:11 p.m.

Binary Search

Binary search is a searching algorithm that works efficiently with a sorted list. Search a sorted array by repeatedly dividing the search interval in half. Begin with an interval covering the whole array. If the value of the search key is less than the item in the middle of the interval, narrow the interval to the lower half. Otherwise narrow it to the upper half.

May 1, 2021, 6:11 p.m.

Mutual Funds

Value Funds

In Value Funds the Fund Manager Looks for the Stocks of the Companies which are undervalued and trade for less than their respective intrinsic values.

They are intrinsically more valuable and have a lot of potential to grow.

In simple words if the company's market value is less than it's intrinsic value, then it is considered to have VALUE

June 20, 2021, 4:05 p.m.

Value Funds

In Value Funds the Fund Manager Looks for the Stocks of the Companies which are undervalued and trade for less than their respective intrinsic values. They are intrinsically more valuable and have a lot of potential to grow. In simple words if the company's market value is less than it's intrinsic value, then it is considered to have VALUE

June 20, 2021, 4:05 p.m.

Equity Mutual Funds

As the name suggests, Equity Mutual funds :

(1)Invest in Shares of different companies of every size whether large cap, mid cap or small cap.

(2)Invest in different sectors in market

(3)Generate better returns than Debt-funds and Term Deposits

June 20, 2021, 3:29 p.m.

Equity Mutual Funds

As the name suggests, Equity Mutual funds :

(1)Invest in Shares of different companies of every size whether large cap, mid cap or small cap.

(2)Invest in different sectors in market

(3)Generate better returns than Debt-funds and Term Deposits

June 20, 2021, 3:29 p.m.

Index Funds

(1)As the name suggests, an Index Mutual Fund invest in stocks of the companies listed on that particular index in stock market .

(2)These funds are passively managed funds means they invest in same stock that are present on that particular index whether sensex or nifty or any other index in same proportion and does not change portfolio composition.

(3)Major Attraction for Index Funds is that they have low expense ratio since they are passively managed funds and there is no need to create any strategy or research.

(4)Taxability - Both Capital Gain and Dividend received are taxable.

(5)An Investor can expect over 10% - 12% return over a period of 7 years.

(6)Low Risk compared to Actively Managed funds.

Feb. 19, 2021, 4:29 p.m.

Index Funds

(1)As the name suggests, an Index Mutual Fund invest in stocks of the companies listed on that particular index in stock market .

(2)These funds are passively managed funds means they invest in same stock that are present on that particular index whether sensex or nifty or any other index in same proportion and does not change portfolio composition.